Dave Tonge, Chief Technology Officer at Moneyhub (one of the alpha dashboard providers for the Pensions Dashboards Programme), reflects on a key lesson from the alpha build phase, how multiple dashboards will really help consumers, and the critical importance of the upcoming beta testing phase.

Collaboration is critical

Moneyhub is delighted to be one of the collaborative partners working with the Pensions Dashboards Programme (PDP), and to have connected our alpha dashboard to the digital architecture last month.

We already knew from our Open Banking experience that cross-industry collaboration is critical to successfully offering consumers more control over their money.

So critical that collaboration has always been one of Moneyhub’s three core values.

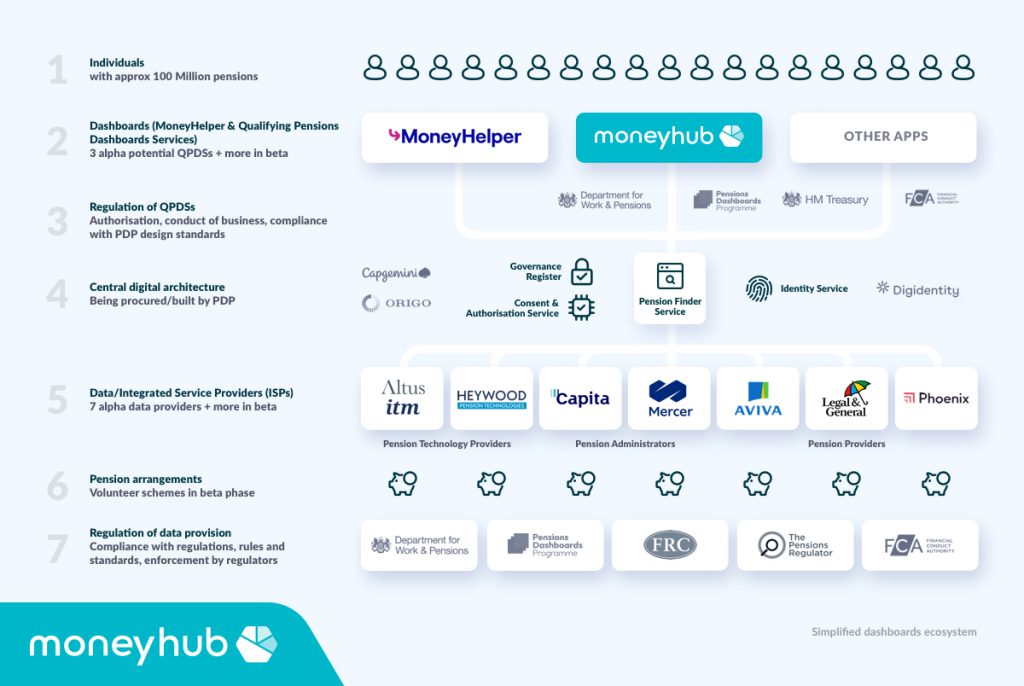

Collaboration has also been key in getting pensions dashboards to work in the alpha phase over the last six months. There’s a huge variety of parties who need to work together to make dashboards a reality. Our simplified ecosystem diagram helps bring this to life.

To us, collaboration includes sharing our knowledge and experience. Such as putting our alpha dashboard in the public domain, and compiling a demo video, a suite of blogs and many other resources in one handy place. This helps to bring an abstract subject to life and helps all parties understand what pensions dashboards could look like, what they are as well as what they are not.

“Our aim is to stimulate debate and generate ideas across different consumer and industry groups, to ensure that, when they’re launched, dashboards work really well for consumers.”

Consumer focus: dashboards on apps people already use

The Government’s policy of having multiple dashboards will also benefit consumers.

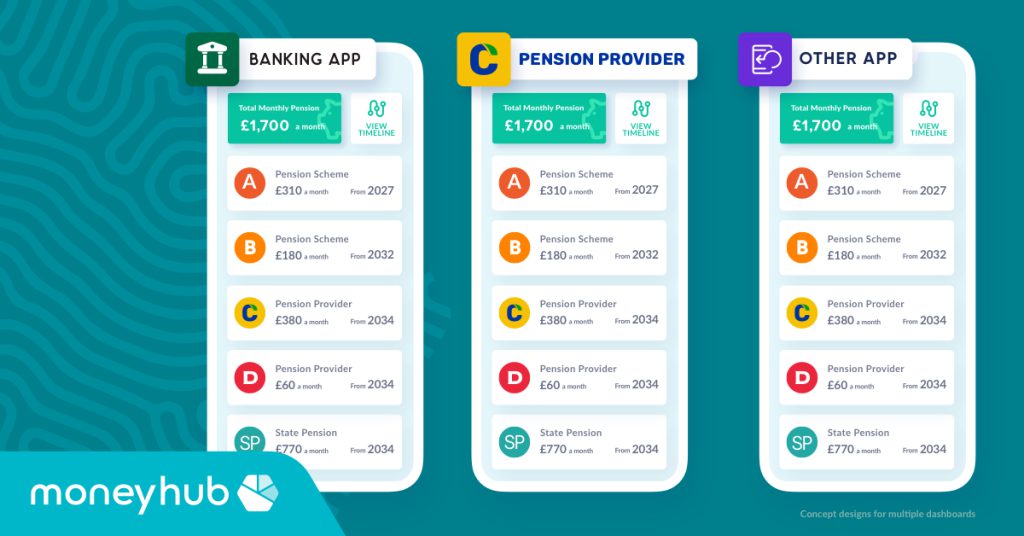

Imagine someone with four pensions: with Schemes A and B, and Providers C and D. Plus State Pension of course. If they are already logging in regularly to their online banking app, it makes sense that they’d want to see all of their pensions in one place without the need of multiple apps.

Or, if they’ve downloaded Provider C’s pensions app, seeing their pensions from their other Schemes and Providers together there could be really helpful. Or they could use another dashboard, such as the Government’s MoneyHelper dashboard.

Multiple dashboards will enable more people to see their pensions together, on apps they are already accustomed to using.

Banks, pension providers, master trusts and other financial organisations are all telling us they want to host their own dashboard, so they can enhance their online experience and services by showing customers all of their pensions together on their existing app or website that they use.

The recent PDP and FCA webinar on how to become a pensions dashboard provider, took organisations through what this might involve.

Next steps: thorough user testing is essential

Looking ahead, working collaboratively with connected volunteer schemes, our combined technology and pensions expert team can’t wait to start beta testing the ecosystem.

We know many consumers’ key questions about their pensions are:

- “What have I got?”

- “Is it enough?”, and

- “What can I do?”

Thorough user testing will ensure users of dashboards can really start to explore these questions. For example, by linking to the PLSA Retirement Living Standards, or by seeing their pensions alongside other assets via existing open finance connectivity.

Simultaneously, we’re looking forward to continuing our close collaboration and information sharing with the programme and wider industry, including responding to the upcoming PDP and FCA consultations on dashboards standards and rules respectively.

All of this work combined will ensure that, when they’re launched, all pensions dashboards will offer a really useful, secure service for consumers, helping them plan for retirement and positively impacting financial wellbeing.