Rita Patel, Lead Analyst for the Pensions Dashboards Programme, explores how PDP’s ongoing programme of research provides the evidence base for decisions relating to pensions dashboards.

At the Pensions Dashboard Programme (PDP) we want to ensure we have a sound evidence base to underpin decisions about strategy, policy and delivery. Our ongoing research programme, together with our industry liaison and user testing work means we can work towards creating a product that will fulfil user needs and expectations. To this end, we have shared our work and thoughts with the DWP and FCA to inform their decisions on the proposed regulations and rules they’ll be consulting on.

Since the start of the programme, we’ve sought to understand the existing evidence base relating to pensions dashboards. As I discussed in an earlier blog, our rapid evidence assessment enabled us to identify information gaps, and we appointed Ipsos MORI in early 2021 to work with us to help us fill some of these.

Our most recent publication is the qualitative research report Ipsos MORI has created on our behalf into the motivations, attitudes and behaviours of users around engaging with pensions via dashboards.

The fieldwork took place in two stages over a period of several months. We published our initial findings in July 2021 and this most recent publication combines the findings of both sets of fieldwork. This research with potential end users of pensions dashboards looked to:

- update the findings from various previous pensions dashboards research studies

- explore the appeal of the pensions dashboards concept itself

- examine views on potential dashboard display contents

- understand attitudes to particular elements of the envisaged customer journey

- investigate tolerances for only partial information about their pensions being available initially

Research findings

Our research found that respondents reacted almost uniformly positively to the concept of pensions dashboards. We believe that dashboards could help drive increased pensions knowledge and engagement across a wide range of users. The age and life-stage of interviewees, together with the number and type of pensions they held influenced the level of appeal, with those at a mid to late stage in their career, and those with multiple pension pots being most interested.

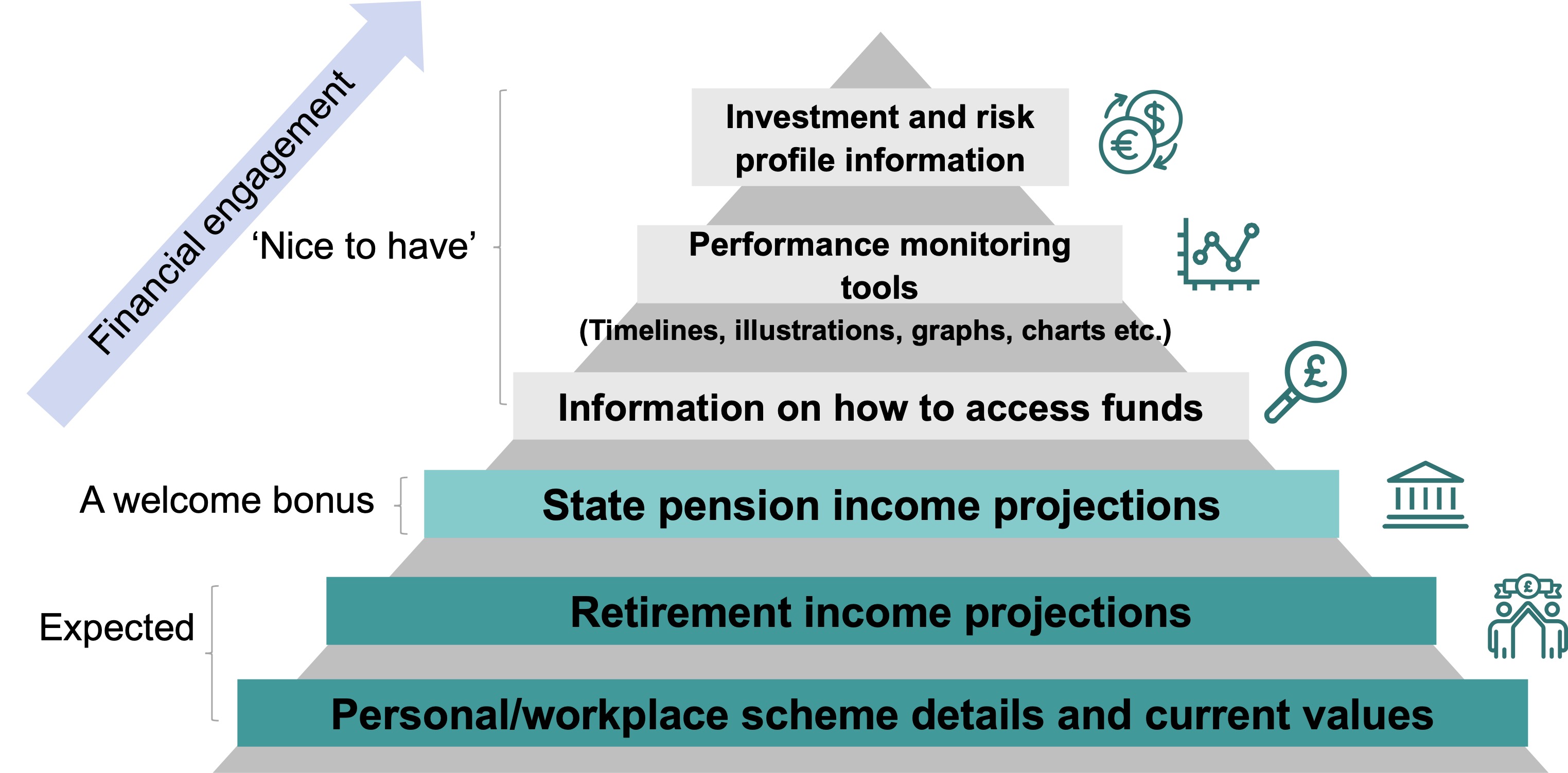

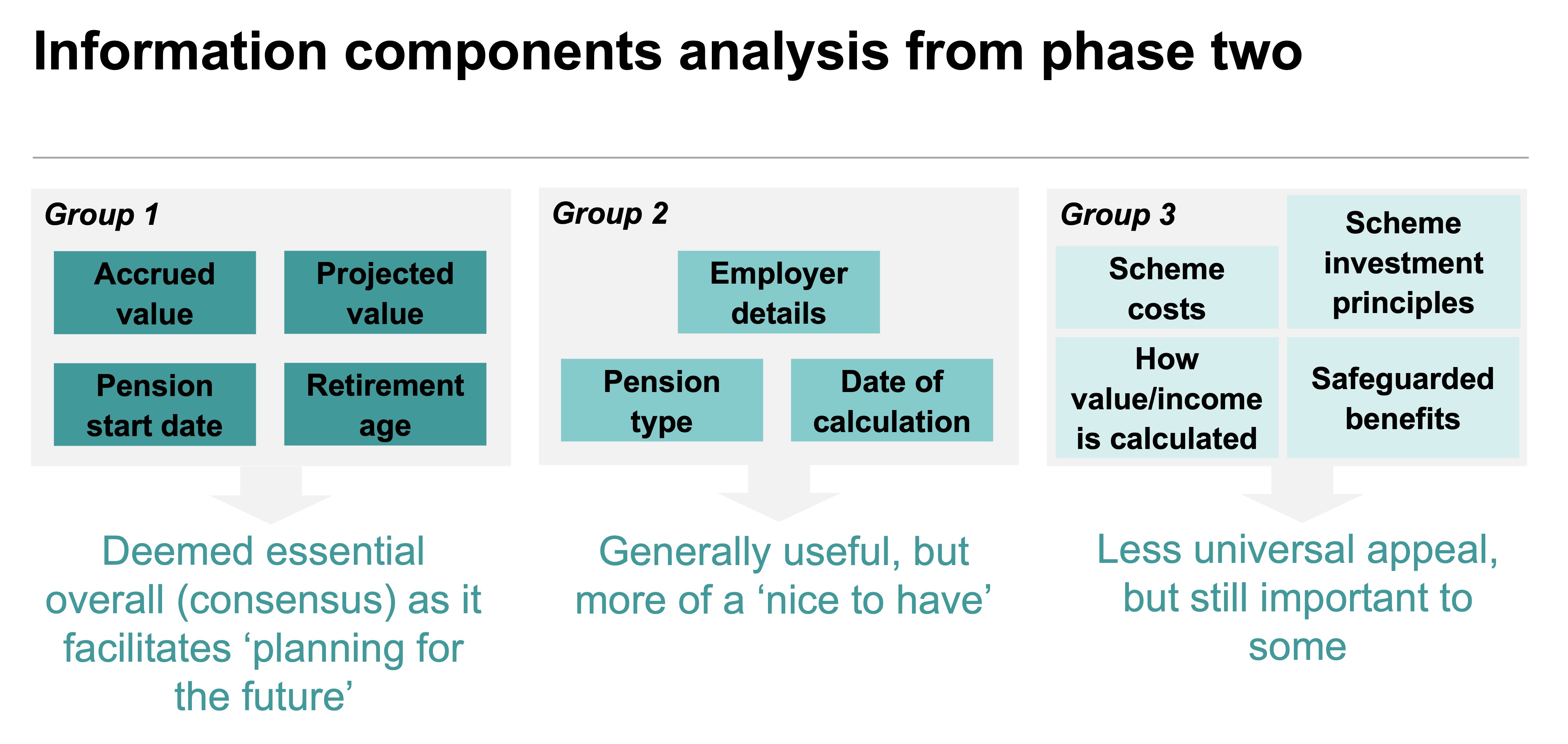

In response to suggestions from our call for input on staging that we explored consumers’ reactions to a find-only service to begin with, we tested reactions to the inclusion or exclusion of different components of information. This identified that a find and view service, containing both accrued and projected value information had a wide level of appeal and resonated with the broadest possible range of potential end users. The research showed that consumers expect to see value information (both accrued and projected) on dashboards. It is a priority in terms of the most essential elements of information for users, along with the pension start date and retirement age.

A find-only dashboard, which located pensions without displaying any values initially was of limited appeal. It was only of interest to individuals who knew they had lost touch with or forgotten the details of their pensions.

When it comes to a completeness of service (find and view or find-only), users expect their information to be available. The results are in line with the main body of evidence we’ve seen, which consistently shows that information about the accrued value and income pensions might provide in retirement are key user needs and part of the minimum consumers expect from a dashboard service. Therefore, a phased or partial service could negatively affect dashboards’ reception.

The full report analyses this in more detail but there is another important finding that I wanted to mention here: it is the importance of communicating the nature of the service effectively to consumers. Dashboard users need to know what the service can (and cannot) do for them, as well as having clear signposting of government backing, in order to increase trust in its security.

Next steps for PDP’s research activity

While we’re pleased to be able to share the results of this qualitative work, this is far from the end of our information gathering and research.

We will continue to work with Ipsos MORI to further examine the wider pensions landscape through analysis of existing social surveys to understand the number and characteristics of those with private pension entitlements to build a picture of potential users. We are also exploring how to quantify and articulate the benefits of dashboards. And, we will be looking to understand how the industry is gearing up to connect to the ecosystem.

In addition, PDP will continue with its programme of user-testing dashboard prototypes (mock-ups) to develop the design standards that will apply to all pensions dashboards. These prototypes will iterate, to ensure that we end up with the most accessible and understandable product for dashboard users.

All of this activity feeds into the wider programme, building the evidence base for our decisions. Ultimately, we want to ensure that we’re creating a service that pension dashboard users expect when finding their pensions online, securely and all in one place.